Story of a failed EHR rollout

In 2013, Richard Petersen, the CEO of the Maine Medical Center, followed the well-established path of Epic EHR implementation. The rollout was expected to cost $160 million across the MaineHealth network, with Petersen’s hospital being the largest of the hospitals. Petersen was confident that the EHR system would be a worthwhile investment, and that the hospital would be able to handle the transition smoothly and successfully.

The EHR system went live in December 2013, and soon after, problems emerged. The system was not properly configured, and caused errors and delays in the billing and charging processes. For example, the system failed to charge for some services, such as C-sections, and generated innacurate or incomplete claims, which led to decreased revenue from payors.

Six months later, Petersen announced that the hospital had lost $13.4M in the first half of the fiscal year due to a decline in patient volumes, increased uncompensated care, and the launch of the EHR.

Most EHR implementations were very expensive

This hospital in Maine was hardly the only one to experience financial hardship from an EHR implementation:

Wake Forest Baptist had a $55M operating loss for 2012-2013 due to business cycle disruptions related to EHR use

Lahey Hospital and Medical center lost $21M and laid off 130 people due to costs associated with EHR implementation in 2015

Early estimates averaged $50-70K/physician for a small outpatient office, but more recent estimates are closer to $14-17K/physician

Ongoing EHR costs are estimated at about $8k/physician, though that number includes hardware upgrades. Other estimates range from a few thousand dollars to $17k/physician/year.

Across all industries, about 66% of all technology projects fail according to the Standish Group’s CHAOS 2020 report, with large projects being successful less than 10% of the time. A McKinsey report found that 17% of large IT projects go so awry that they threaten the company’s existence. This failed or suboptimal technology costs $260B in the US alone, with the estimated costs due to operational failures closer to 1.5T.

Contributors to Health tech implementation expenses

Healthcare’s notable complexity makes financial success even more unlikely. Despite the government providing $44-63K/physician over five years if they had at least 30% Medicare or Medicaid patients, many clinics and hospitals ended up with a deficit. There are several causes of EHR implementations causing a net negative financial picture:

Decreased clinical volume during implementation

As discussed last week, most EHRs recommend decreasing elective patient volumes drastically during implementation, often to as few as 2-4 patients per day in clinic and decreasing the surgical volume by at least half. This translates into large revenue losses, and those patients may or may not come back to your hospital system.

High staffing and training costs

You need a lot of extra people around to make sure implementation goes smoothly and extra people are expensive

The cost of the EHR itself

The technology is expensive, and was generally not completely offset by the government incentives

Previous information and charts also have to be converted to electronic form

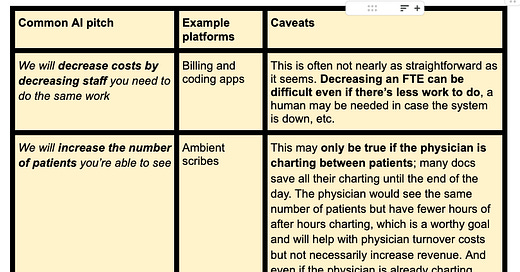

The fact that EHR implementations were not financially viable even with government payments is an important point, because there’s no government mandate and therefore no anticipated government assistance with AI products. So the AI platforms have to sink or swim financially on their own merits. My guess is that most AI products will be pitched as actually increasing patient volumes and decreasing staffing costs, as well as increasing charge capture. Those assertions may be true eventually, but they may look more like EHRs in the implementation phase.

The illusory promise of cost savings

The health tech entrepreneurs I’ve talked to since the most recent downturn have said that hospital leaders don’t want to hear about cost savings. They’ve been burned too many times by promises of cost savings that never materialized and often just don’t believe that argument. As a palliative care physician, I’ve had to demonstrate cost savings for our programs to justify their existence. There is robust literature about cost savings for palliative care, but on a year-to-year, hospital-specific basis, it can be exceedingly difficult to show real savings without advanced statistical modeling. New AI platforms don’t have multiple trials demonstrating cost reduction and will have to make multiple assumptions in their financial models.

That’s not to say those platforms can’t actually save money. A well-known report by McKinsey and the Harvard Economics Department projects a savings of 5-10% in costs per year for the US healthcare system, or $200-360B in annual spending. Value based care models are especially reliant on cost savings, and they will likely be scrutinizing these claims more closely than in previous years as they anticipate CMS’s goal of having every Medicare and most Medicaid patients in a VBC plan by 2030.

Payment for SaaS vs SaMD

One major part of paying for AI is determining whether a product is SaaS vs SaMD . The SaaS products aren’t reimbursable by third party payors, so they have to be more creative on the finance side. The AI-enabled SaMD products are slowly becoming billable, though they have to make it through the long and expensive FDA medical device process.

The confusing and likely changing landscape of AI reimbursement

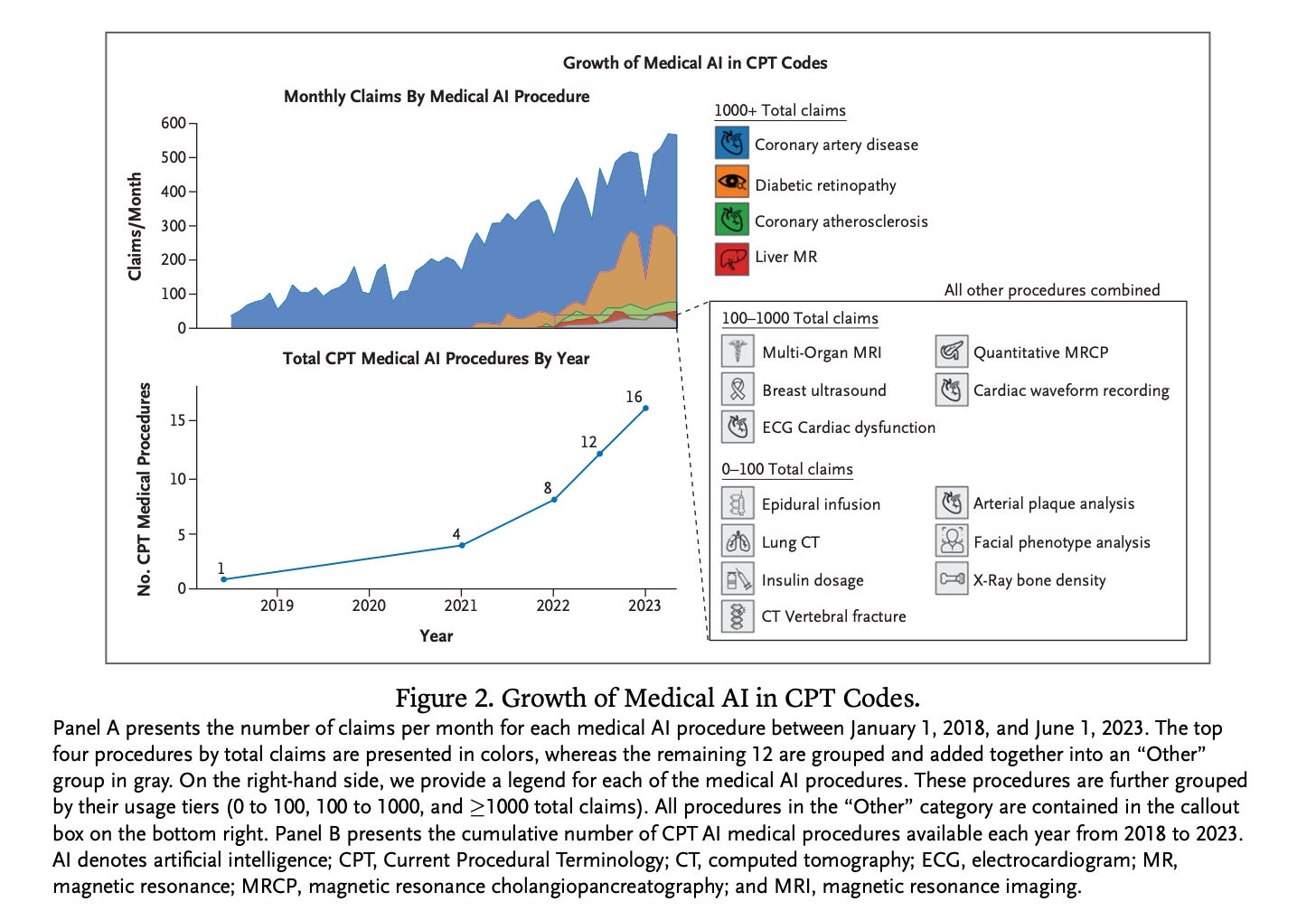

CMS started reimbursing for AI in 2020, and there are now over 500 AI products that are approved by the FDA but only 16 that can be considered reimbursable. A new paper demonstrates that a handful of platforms account for the vast majority of AI-related reimbursements, and they are more likely to be used in areas with higher income, in academic centers, and in larger cities.

There are two main ways AI is reimbursed:

New Technology Add-On Payment (NTAP)

Mostly inpatient addition to DRG payments for inpatients

CPT codes for both inpatient and outpatient payments

Characterizing the Clinical Adoption of Medical AI Devices through U.S. Insurance Claims

Most AI platforms are currently not billable. There’s a recognition that AI could be of great use in situations like diagnosing diabetic retinopathy in rural areas where there are no ophthalmologists, but also substantial concern about waste and fraud. Given the push toward Value Based Care and the perception that AI should decrease workload, there’s substantial governmental concern about reimbursing on a fee for service model. Notably, Europe doesn’t seem inclined to cover AI at all. The government is still trying to figure out the best way to handle AI reimbursements, led in the US by the FDA Digital Health Center and CMS.

The effect of costly health IT affect patient care

When the Maine hospital announced its operating loss, the CEO “cut costs and instituted a hiring freeze”, and the board later terminated his contract.

I want to dive a little more deeply into this concept of a CEO “cutting costs and instituting a hiring freeze” to pay for health technology. I think we all know that cutting costs and decreasing personnel in healthcare can lead to literally life-threatening situations. Because hospital costs are fungible and the money to pay for health IT has to come from somewhere, that ‘somewhere’ is ultimately the same pot of money that pays for clinical care. So when a health tech product really gets the billing (or scheduling, or anything else that affects reimbursement) wrong, it affects not just the bottom line but also our patients.